And The Next Catalyst To Watch

Not a collapse.

A posture change.

When posture changes, money rotates the same way it always has:

Less leverage.

More caution.

More respect for cash flow and hard value.

The clearest signals right now are coming from three places at once.

The consumer

The job market

Risk assets like crypto

When those three line up, it usually means the market is preparing for something.

Signal One

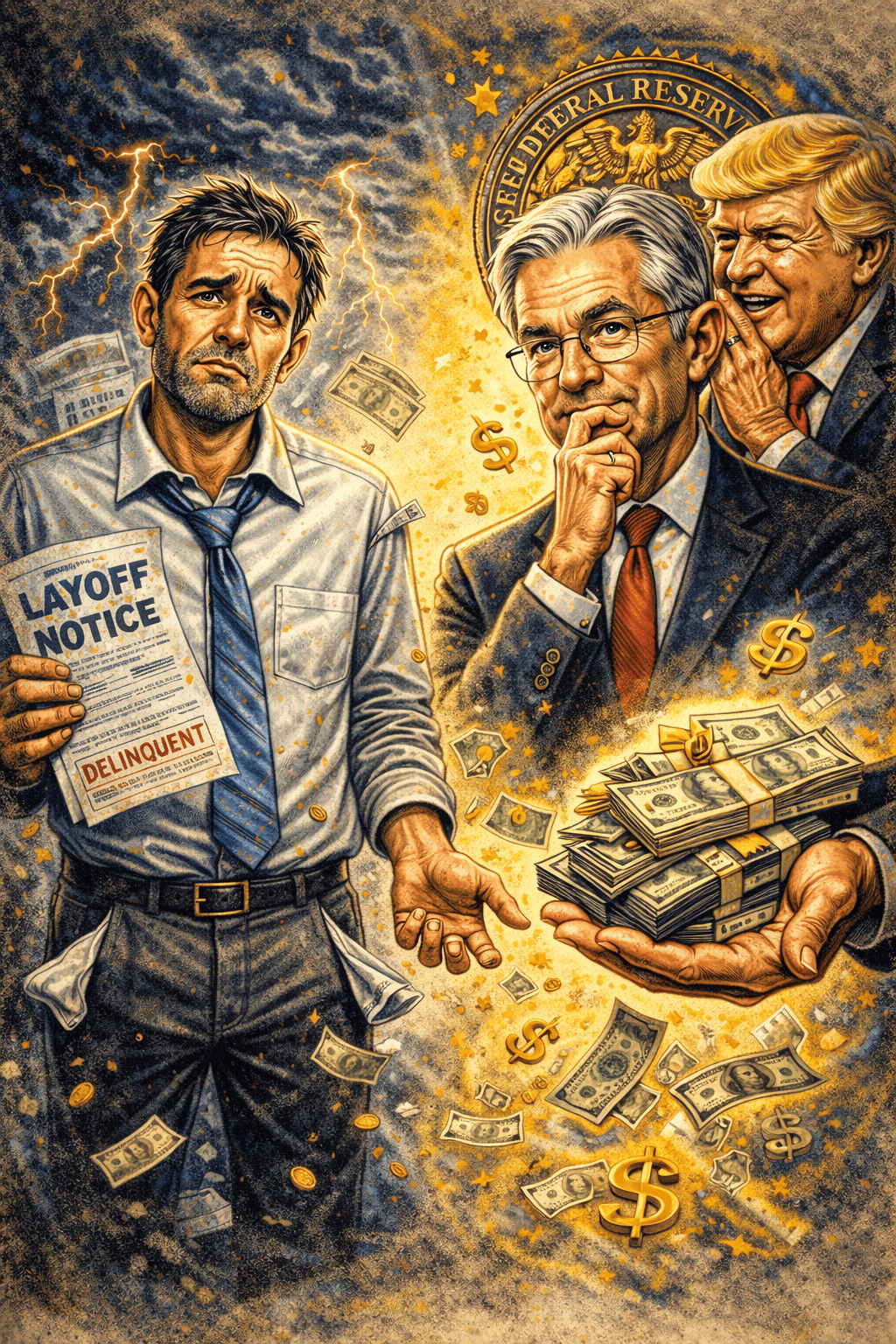

Consumer Stress Is Rising

Household debt just pushed higher again, and delinquency is rising with it.

The latest household credit data shows overall delinquency rising to about 4.8 percent, up from about 3.6 percent a year earlier, with stress showing more sharply in lower income segments.

This matters because consumer stress does not stay contained.

It eventually shows up in:

Spending

Credit availability

Default expectations

And sentiment

When delinquencies rise, the system starts pricing tighter conditions.

That is not a headline.

That is a shift.

Signal Two

Layoffs Are Flashing Early Warning

January job cut announcements came in at 108,435, the highest January level since the Great Recession era.

Job cuts do not automatically mean recession.

But they change psychology fast.

When layoff talk rises, households become defensive.

They spend less.

They take fewer risks.

They delay decisions.

That behavior is what markets front run.

Does This Give The Next Fed Chair Cover To Cut Rates

It can.

Rising delinquencies plus a softening labor picture creates the political and economic cover for easier policy.

But the Fed does not cut just because people are stressed.

It cuts when inflation allows room and when stability looks threatened.

So the real question is not whether the Fed can cut.

The real question is:

Will upcoming inflation and employment data validate the stress signal

If yes, the path to cuts becomes easier.

If no, markets may remain volatile while they debate the timing.

That debate is a catalyst by itself.

Signal Three

Crypto Is Getting Hit Like Liquidity Is Tightening

Crypto usually tells the truth about risk appetite before other assets do.

The recent move has been sharp.

Bitcoin recently traded down near 60,057, its lowest level since October 11, 2024.

Ether fell to the low 2,000s and was cited around 2,068, a level not seen since May 2025.

XRP slid to levels reported as the lowest since November 2024, cited around the 1.60 area during the worst of the drop.

Why is this happening

Because when the market goes risk off, crypto tends to be first in line for de leverage.

That does not mean crypto is finished.

It means liquidity and positioning are being repriced.

Could it go lower

Yes.

When liquidity thins, price often overshoots.

Both down and up.

The key point is not calling a bottom.

The key point is recognizing that risk appetite has changed.

So What Does This Mean For Gold and Silver

This is where the hot money question gets real.

When consumer stress rises and layoff headlines pile up, the market begins to lean toward:

Protection

Stability

Assets that do not depend on perfect policy execution

Gold tends to benefit when:

Confidence softens

Real yields fall

Or the market starts believing rate cuts are back on the table

Silver is different because it carries two identities.

Hard asset psychology and industrial demand.

When money rotates into hard assets, silver can move in bursts because it is smaller and more emotional.

This is exactly the environment where the gold and silver relationship starts to matter again.

Not as a trade.

As a signal.

Trade Deficit

Why It Still Matters Even With Tariffs In The Background

The latest trade data showed the goods trade deficit widening sharply, with the goods deficit cited around 86.9 billion for November.

This matters because it reminds markets of something simple.

Policy headlines do not rewrite structural demand overnight.

A widening deficit can reignite:

Currency narrative pressure

Growth debates

Policy escalation talk

It also feeds the next big question.

What is the next catalyst that forces a decision

The Next Catalyst

What Could Move Everything From Here

Here are the catalysts most likely to matter next.

- Inflation reports

If inflation cools while stress rises, rate cut expectations gain strength. - Jobs data

If layoffs start translating into broader unemployment measures, the narrative shifts quickly. - Fed leadership direction

Markets trade clarity, even before policy changes. - Government funding deadlines

Even when resolved, the uncertainty creates positioning shifts. - Liquidity conditions

Treasury supply, funding markets, and credit spreads often lead the next move. - The next risk event

Markets do not need a crisis. They only need a reason to tighten posture further.

The Vincent Vibe Takeaway

This is not one story.

It is a cluster of signals pointing in the same direction:

The consumer is under pressure.

The job market is showing strain in announcements.

Risk assets are trading like liquidity is thinner.

When signals cluster, money stops debating and starts rotating.

That rotation is the shift.

The edge is not predicting the exact next tick.

The edge is seeing where confidence is leaking and where protection is quietly being rebuilt.

A Simple Lucky Guide Ritual For Weeks Like This

Pick one signal to watch and ignore the noise.

Consumer stress.

Jobs.

Liquidity.

Then do three things:

Reduce rushed decisions.

Strengthen your cash discipline.

Only act where you feel prepared.

Preparedness is the real advantage in volatile seasons.

Luck is when opportunity meets preparedness.

Winners do not quit.

LuckyBets.com

They adjust when the cheese moves.