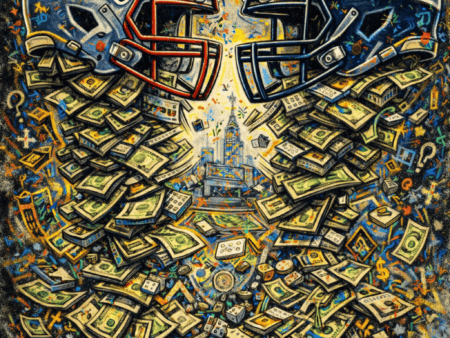

The betting landscape is changing fast. For years DraftKings, FanDuel, and other traditional sportsbooks have owned the action. But a new player is stepping on the field with momentum, prediction markets.

What Are Prediction Markets

Unlike a sportsbook where you place a bet against the house, a prediction market works like an exchange. You buy or sell contracts tied to an event. If the outcome happens, the contract pays out in full. If not, it settles at zero. The price of that contract tells you the market’s view of the probability. A contract trading at 62 cents signals a 62 percent chance of happening. Bettors trade both sides, adjusting positions as odds shift in real time.

Why They Matter

Prediction markets operate under different rules. Many fall under federal oversight, not the patchwork of state by state gambling laws that DraftKings and FanDuel navigate. That gives them a wider potential reach. Even more important, they can offer sharper odds. Without the built in sportsbook margin, prediction markets reflect closer to pure probabilities. For serious bettors, that difference matters.

The Pressure on DraftKings

The moment Kalshi announced NFL same game style prediction contracts, shares of DraftKings and Flutter Entertainment dropped by double digits. Investors saw it as a warning shot. If users can trade the same style of props and parlays on a market exchange with tighter pricing, the sportsbook’s high margin product lines are at risk. Analysts have already adjusted earnings expectations downward, noting that prediction markets could bleed away volume.

Robinhood Steps In

It is not just niche platforms. Robinhood, the trading app that made stock investing mainstream, has entered the prediction market space. That means millions of existing users can trade event outcomes right inside a finance app. For casual players this blurs the line between speculation on stocks and speculation on games. It also means DraftKings is no longer just competing with sportsbooks but with financial technology giants.

Advantages Prediction Markets Hold

- Lower margins give traders more value.

- Broader reach across states where sportsbooks cannot operate.

- Flexibility to list events outside traditional sports betting categories.

- Integration with finance apps that already hold users’ trust.

What Could Slow Them Down

Liquidity remains the challenge. Without deep pools of buyers and sellers, prices can be skewed and large bets can move the market too much. Regulatory clarity is also not final. While the Commodity Futures Trading Commission has allowed certain products, the line between gambling and derivatives is still being tested. A sharp legal reversal could slow expansion.

The Next Battle

Sportsbooks will not sit still. Expect DraftKings and others to roll out exchange style features or acquire their own prediction market tech. Expect new marketing campaigns to emphasize the entertainment and rewards that prediction markets cannot match. This will not be a zero sum game. Some bettors will prefer the simplicity of fixed odds while others migrate to trading style markets.

What It Means for Bettors

October 2025 marks the point when prediction markets moved from curiosity to competitor. For the bettor, this means more options and possibly better value. The edge may no longer come just from knowing the players and the numbers but from choosing the right platform to place that belief. As with all lucky traditions, the best edge is preparation.

Luck is not a windfall, it is the meeting point of belief and preparation. When the game changes, the prepared mind seizes the edge and turns uncertainty into opportunity.

LuckyBets.com