This content reflects market observations and pattern recognition. It is not financial or investment advice.

LuckyBets helps people recognize when outcomes are shifting before the crowd does.

This report is not about predictions. It is about noticing changes in behavior, supply, and pressure while they are still uneven and misunderstood.

1. The shift

Two signals are strengthening at the same time.

Silver continues to attract attention as a hard asset tied to real world demand, and housing is showing signs of rising stress beneath the surface, even as mortgage rates have recently eased.

When tangible assets regain interest while household pressure increases, it often signals a broader transition in how people think about security, affordability, and risk.

That combination rarely appears by accident.

2. What changed

Silver continuation

Silver is not moving on speculation alone. It sits at the intersection of industrial necessity and monetary perception.

Silver is the most electrically conductive metal in use, which makes it difficult to replace in modern systems. As electricity usage grows through electric vehicles, renewable energy infrastructure, data centers, and artificial intelligence computing, demand for efficient conductive materials rises with it.

Unlike gold, much of the silver used in industry is consumed and dispersed. Once embedded in electronics and infrastructure, a meaningful portion is not economically recoverable. This creates a quiet imbalance between long term use and replacement.

At the same time, silver supply does not scale quickly because it is often produced as a byproduct of mining other metals. Production responds slowly, even when demand increases.

These conditions explain why silver keeps re entering the conversation during periods of transition. It is both useful and finite.

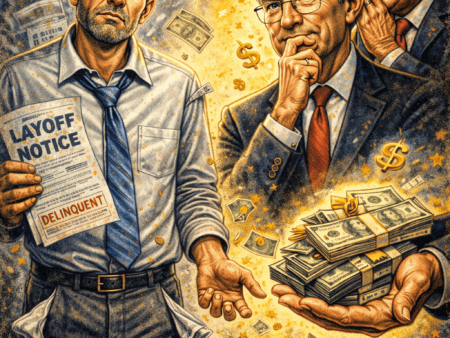

Housing pressure

Housing stress is increasing in specific pockets, even though the overall market does not appear to be collapsing.

Foreclosure activity has risen compared to the previous year, though it remains below levels seen during past housing crises. This is not a crash signal. It is a pressure signal.

Pressure matters because it changes behavior.

Some homeowners are facing payment strain, rising insurance costs, higher taxes, or life events that force decisions sooner than planned. At the same time, buyers are adjusting expectations as rates move lower but affordability remains tight due to pricing and ownership costs.

This creates uneven conditions, not uniform outcomes.

3. Where the crowd is late

The crowd tends to think in extremes.

Housing is either fine everywhere or failing everywhere. Silver is either a forgotten metal or a guaranteed windfall.

Neither view is accurate.

The real shift is happening in the middle.

In housing, opportunity and risk are appearing unevenly. Motivated sellers are emerging quietly. Buyers with patience and flexibility are gaining leverage in specific markets. Sellers who still have equity but feel rising pressure may choose to act before conditions tighten further.

In silver, attention is returning not because of headlines, but because structural demand and supply realities are becoming harder to ignore.

The crowd usually arrives only after these dynamics become obvious.

4. Where luck lives right now

Luck is not randomness.

Luck is alignment.

In housing, alignment means recognizing stress before panic sets in. It means understanding that rising foreclosure activity can create both buying windows and selling urgency, depending on individual circumstances.

For some, alignment may mean exiting early while equity remains. For others, it may mean preparing to act when motivated sellers appear.

In markets, alignment means noticing when attention shifts back toward tangible assets as confidence in financial systems wavers at the margins.

Silver fits that environment because it sits between industry, energy, and monetary identity.

When those forces move together, outcomes start feeling less random.

5. What to watch next

Housing

Watch whether foreclosure activity continues to rise beyond isolated regions into broader areas. Watch whether lower mortgage rates translate into real buyer demand or simply slow the pace of decline.

Also watch whether recent government efforts to support mortgage markets meaningfully change affordability, or only soften conditions at the edges. Large interventions often stabilize sentiment more than pricing, at least initially.

Silver

Watch how silver behaves during pullbacks. Assets that hold gains during periods when they typically retrace often signal that positioning has changed beneath the surface.

Stability during weakness can be more telling than strength during rallies.

The LuckyBets close

When outcomes begin to shift, most people wait for consensus.

LuckyBets watches for the moment when pressure is rising, attention is rotating, and the crowd is still debating what it means.

That is when alignment starts to feel like luck.

When curiosity meets conviction, opportunity stops feeling random. Luck shows up when you are paying attention while others are still debating.

LuckyBets.com