Every so often, an asset stops behaving the way it used to.

It does not explode overnight.

It does not announce itself loudly.

It simply begins to act differently.

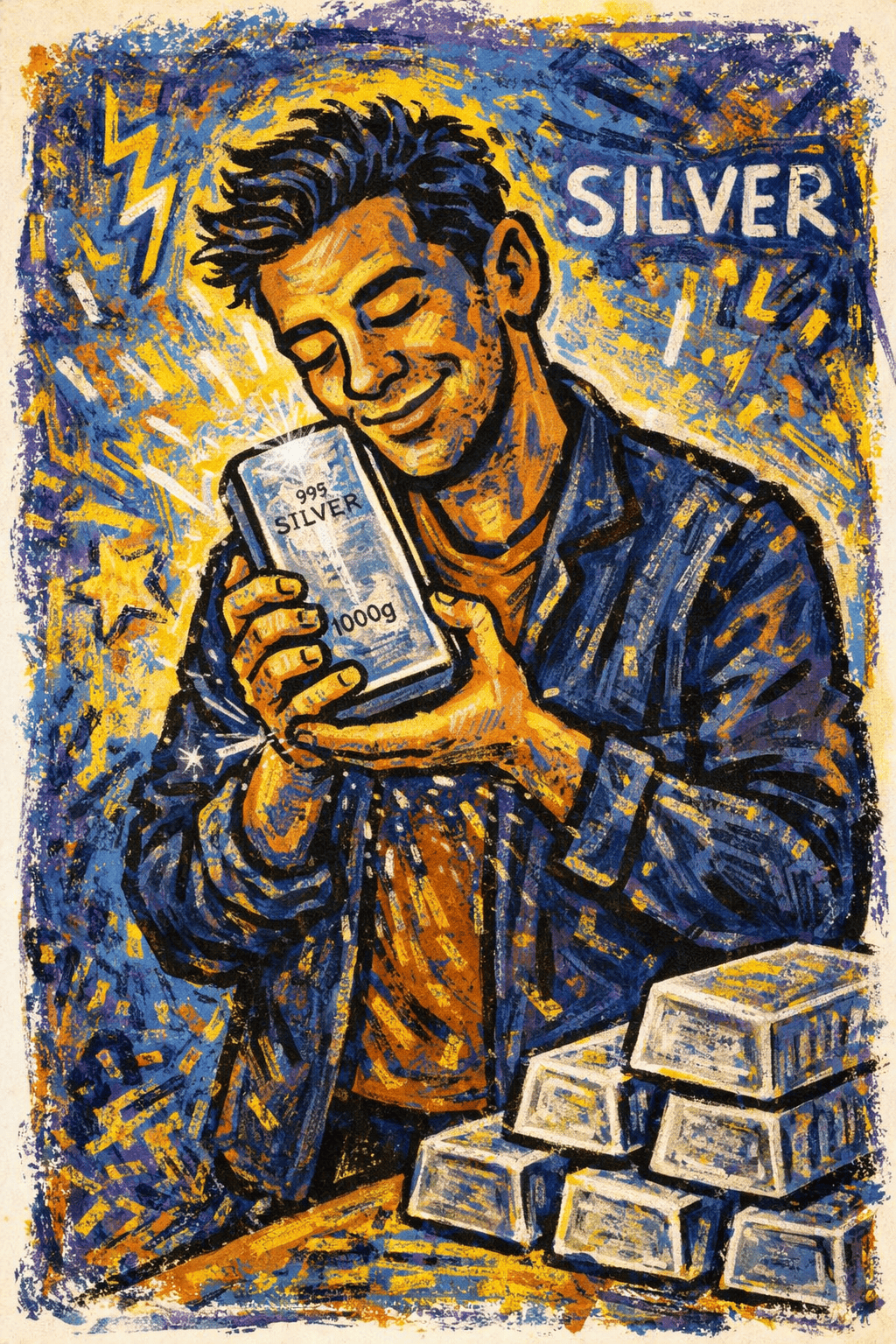

That is what is happening with silver right now.

Silver bullion has been quietly rallying, drawing renewed attention from traders, long term holders, and macro focused observers who tend to notice shifts before headlines catch up. When something long overlooked starts holding higher ground, people who understand cycles pay attention.

Not because of hype.

Because of alignment.

Why Silver Is Back In The Conversation

Silver occupies a unique position in the global system. It is both a monetary metal and an industrial material. That dual role is exactly why it becomes interesting during periods of transition.

On one side, concerns around long term debt, currency stability, and monetary policy have brought renewed interest in hard assets that exist outside purely financial systems.

On the other, industrial demand for silver continues to grow as modern infrastructure becomes more energy and technology dependent.

When those forces overlap, silver behaves differently than gold. It becomes more volatile, more sensitive to sentiment, and more responsive to shifts in demand.

That sensitivity is often where opportunity begins to form.

The Electricity Factor Few People Talk About

Silver is the most electrically conductive metal on earth. No other metal carries electrical current more efficiently.

That property makes silver extremely difficult to replace in many critical applications, even when prices rise. It is used in electronics, circuitry, power controls, and advanced electrical systems where performance matters.

Unlike gold, which is primarily stored and recycled, much of the silver used in industry is consumed. Once embedded into electronics and components, a meaningful portion is lost, dispersed, or too costly to recover at scale.

That creates a quiet imbalance between use and replacement.

Where Demand Is Quietly Accelerating

Modern systems are becoming more electricity intensive, not less.

Electric vehicles rely on silver in batteries, power management systems, and charging infrastructure. Renewable energy technology uses silver in solar panels and grid components. Large scale data centers and artificial intelligence supercenters depend on dense, efficient electrical networks where conductivity matters.

As computing power expands and energy consumption rises, demand for materials that optimize electrical flow rises with it.

Silver sits directly in the path of that trend.

The Supply Side Reality

Silver supply does not respond quickly to rising demand.

Most silver is not mined on its own. It is commonly produced as a byproduct of mining other metals such as gold, copper, lead, and zinc. That means production decisions are driven by those markets, not silver itself.

Even if silver demand increases sharply, supply cannot easily be turned up unless mining activity for other metals expands as well.

This structural lag is why silver markets often tighten suddenly rather than gradually.

Why People Are Talking About Extreme Outcomes Again

Claims that silver could rise dramatically surface during every major cycle. Some are exaggerated. Some are rooted in historical comparisons. Some reflect emotion more than analysis.

LuckyBets does not make predictions.

What matters is not whether specific numbers are reached, but why people are asking the question again in the first place.

Assets do not attract extreme narratives unless something underneath them has shifted.

That renewed curiosity is the signal.

Why This Fits The LuckyBets Lens

Luck is not randomness.

Luck is alignment meeting awareness.

When outcomes begin to shift, people often feel it before they can fully explain it. That sensation is not superstition. It is pattern recognition catching up to reality.

Silver feels different right now because multiple forces are moving in the same direction at the same time.

Industrial demand

Energy infrastructure

Technological expansion

Supply constraints

Monetary uncertainty

When those forces align, behavior changes.

People notice.

The Takeaway

Silver’s recent movement is not about certainty.

It is about transition.

And transitions are exactly where LuckyBets lives.

We do not tell people what to buy.

We do not tell people what will happen.

We focus on recognizing moments when the environment itself is changing, so readers can decide for themselves how closely they want to pay attention.

Because by the time everyone agrees, the shift has already happened.

When the environment begins to shift, alignment feels like luck. Those who notice it early do not chase outcomes, they recognize momentum before it speaks.

LuckyBets.com