Trading Your Expertise Is Becoming the New American Side Hustle

Something big is happening in plain sight.

Prediction markets are exploding because they turn everyday knowledge into something tradable. Not in theory. In real volume, real participation, and real money moving through contracts tied to outcomes.

If you are a basketball expert, you can trade your edge on basketball outcomes.

If your uncle is a politics expert, he can trade his edge on political outcomes.

If you live and breathe economics, you can trade your view on inflation, rate decisions, and recession odds.

That is the shift.

The world is turning beliefs into markets, and markets into signals.

Why This Feels Different Than Old School Betting

Traditional betting was built around the house and the line.

Prediction markets are built around the crowd and the price.

Instead of fixed odds, you get a moving probability.

Instead of placing one bet and waiting, you can trade in and out.

Instead of only sports, it can be politics, economics, pop culture, or global events.

In other words, this is not just wagering.

It is participation in a live marketplace for outcomes.

The California Moment

Why This Feels Like Freedom

For years, if you lived in California and wanted to place a traditional legal sports bet, the cleanest path was often to travel to Nevada.

That shaped behavior.

It turned betting into an event.

It limited frequency.

It filtered out casual participation.

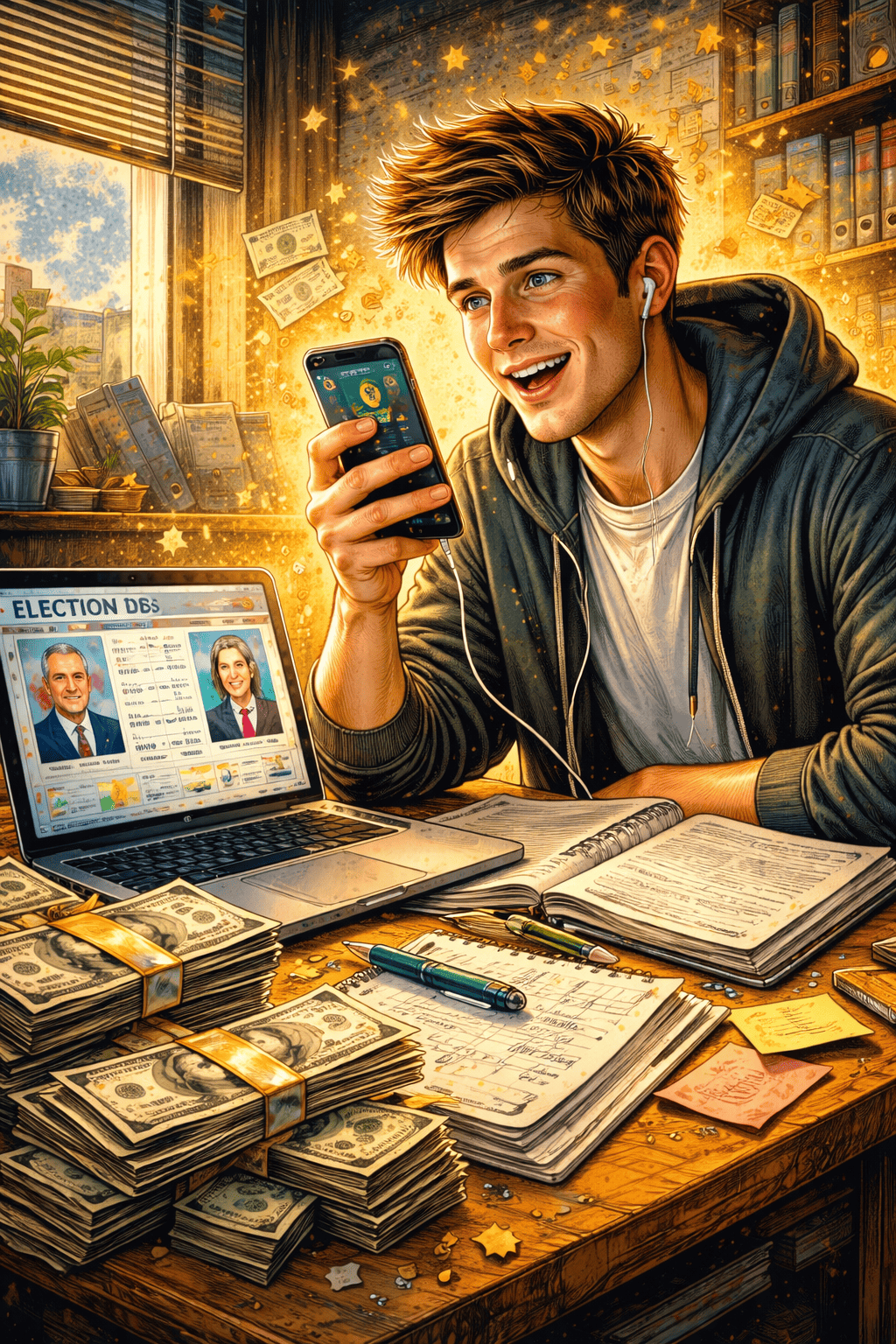

Now, people are interacting with outcomes from home, on a laptop, from their pajamas.

Not because they suddenly became gamblers.

Because the format matches modern life.

If you already research the Lakers, why should your insight only live in your group chat.

If you already track politics daily, why should your analysis stop at being right on social media.

Prediction markets turn research into a position.

The Platforms Fueling the Explosion

This boom is not coming from one app. It is coming from a convergence.

Kalshi has pushed regulated event contracts further into the mainstream, including sports style markets and major news events.

Polymarket has become a giant in the category globally, with massive volumes around elections and cultural events.

And now the gravity is pulling in the rest of the ecosystem.

Sports betting brands want a seat at the table because prediction markets behave like exchanges. Crypto platforms want a seat because event contracts fit naturally with crypto settlement and trading culture.

When multiple industries chase the same lane, it is usually because the lane is widening fast.

The Real Proof

The Numbers That Changed Everything

The moment prediction markets stopped being a niche hobby was when single events started doing numbers that looked impossible.

One recent Super Bowl cycle produced roughly one and a half billion dollars in prediction market trading on the game. That is a coming out party. It signals scale, habit, and mainstream curiosity.

Even people who do not care about the industry heard the phrase prediction markets and suddenly understood it.

Because nothing explains a movement like volume.

Why This Market Keeps Growing

The Psychology Is Simple

Prediction markets are growing because they satisfy three human urges at once.

1. The urge to be right

People want a scoreboard for their beliefs.

2. The urge to be early

It feels good to see something before the crowd does.

3. The urge to monetize attention

If you spend time researching anyway, the market rewards you for being correct.

This turns casual obsession into tradable focus.

Sports nerd becomes analyst.

Politics junkie becomes forecaster.

Macro watcher becomes probability trader.

Real World Examples

People Who Turned Insight Into Real Money

This is where it gets real.

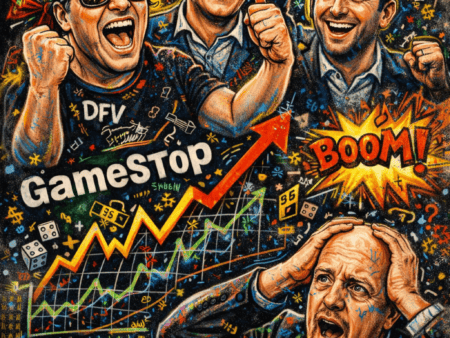

The trader who exploited Google search behavior

A widely discussed example involves an anonymous trader known online as AlphaRaccoon, tied to a wallet that reportedly made around a million dollars by correctly predicting most of the outcomes in Google Year in Search markets.

The important part is not the headline number.

The important part is the method.

They treated it like research.

They focused on where the crowd was overconfident.

They used probability mispricing as the edge.

Whether you view that story as skill, data advantage, or something controversial, it proved one thing.

When attention becomes a market, information becomes currency.

Super Bowl volume and the rise of sports outcome trading

On major sports events, prediction markets now attract activity that looks like a financial exchange, not a sportsbook.

That matters because it creates a new kind of participant.

Not just fans.

Not just bettors.

Traders.

People who care less about rooting and more about timing, price, and exits.

Is This Affecting Gambling Stocks

It is already pressuring the conversation.

Traditional sportsbooks make money through pricing, spreads, and hold.

Prediction markets change the structure because:

- they look and feel like trading platforms

- they can create massive volume due to in and out trading

- they attract a different user who wants flexibility, not a one time wager

If prediction markets keep growing, sportsbooks will be forced to adapt. Some will partner. Some will build. Some will lobby. Some will lose share.

The bigger point for LuckyBets is not who wins the corporate race.

The bigger point is what this reveals about where money and attention are heading.

When a new market lets people trade what they already care about, participation expands.

And when participation expands, businesses form around it.

The Lucky Position Idea

Invest in what you love, then sharpen it

Here is the clean truth.

Most people spend years becoming experts without ever being paid for it.

Prediction markets offer a new path.

If you love basketball and you truly understand rotations, matchups, travel spots, and injuries, you can trade outcomes where the crowd is mispriced.

If your uncle lives and breathes politics and can spot narrative manipulation and late swing signals, he can trade outcomes where headlines are ahead of reality.

If you track economics and know when the market is lying to itself about cuts, inflation, or recession odds, you can trade outcomes where probability is wrong.

This is not a guarantee.

But it is a new doorway.

And doorways are where luck often begins.

What to watch next

The next catalyst for this industry

Prediction markets are expanding on two fronts at once.

More events

More categories, more contracts, more reasons to trade.

More regulation and scrutiny

As money grows, oversight grows.

This is not a threat. It is a sign of legitimacy.

When regulators pay attention, it means the market matters.

The Vincent Vibe Takeaway

Prediction markets are exploding because they do something simple.

They reward preparation.

In the old world, being right mostly fed your ego.

In the new world, being right can become a position.

That is a shift in how people relate to information.

Luck is not random here.

Luck is opportunity meeting preparedness.

If you already have expertise, the opportunity is now obvious.

The only question is whether you show up prepared enough to use it.

The world trades beliefs now.

LuckyBets.com

Preparation turns belief into a position.